Order Types & Liquidity on Nexo Pro: Deep Dive

Have you tried Nexo Pro yet? Our new trading platform is the ideal place for beginners to set their first limit order or automated strategy. Trading, however, isn’t quite like earning interest, where you simply hold crypto in your wallet. There are a few terms, features, and buttons you’d best get acquainted with before starting. That’s why we’ve prepared a walkthrough of the platform, so you master Nexo Pro in a flash. And what better time to do it — until the end of November, we have a 50% discount on all trading fees on the platform. So let’s get started.

What Is Crypto Spot Trading?

Your first real encounter with Nexo Pro is going to be the Spot Trading screen. It’s the place where you directly purchase or sell crypto assets on a publicly-open financial market. There are two ways to make profits on the spot market:

- Longing – buying an asset and selling in the future when its value has risen.

- Shorting – selling now and repurchasing when the price decreases.

How Do Orders and Crypto Pairs Work In Practice?

Successful spot traders utilize a variety of orders for their short and long-term strategies. There are different types of orders that you can place on Nexo Pro, depending on your investing style. They allow you to execute more effectively and, when done right, can help you profit more.

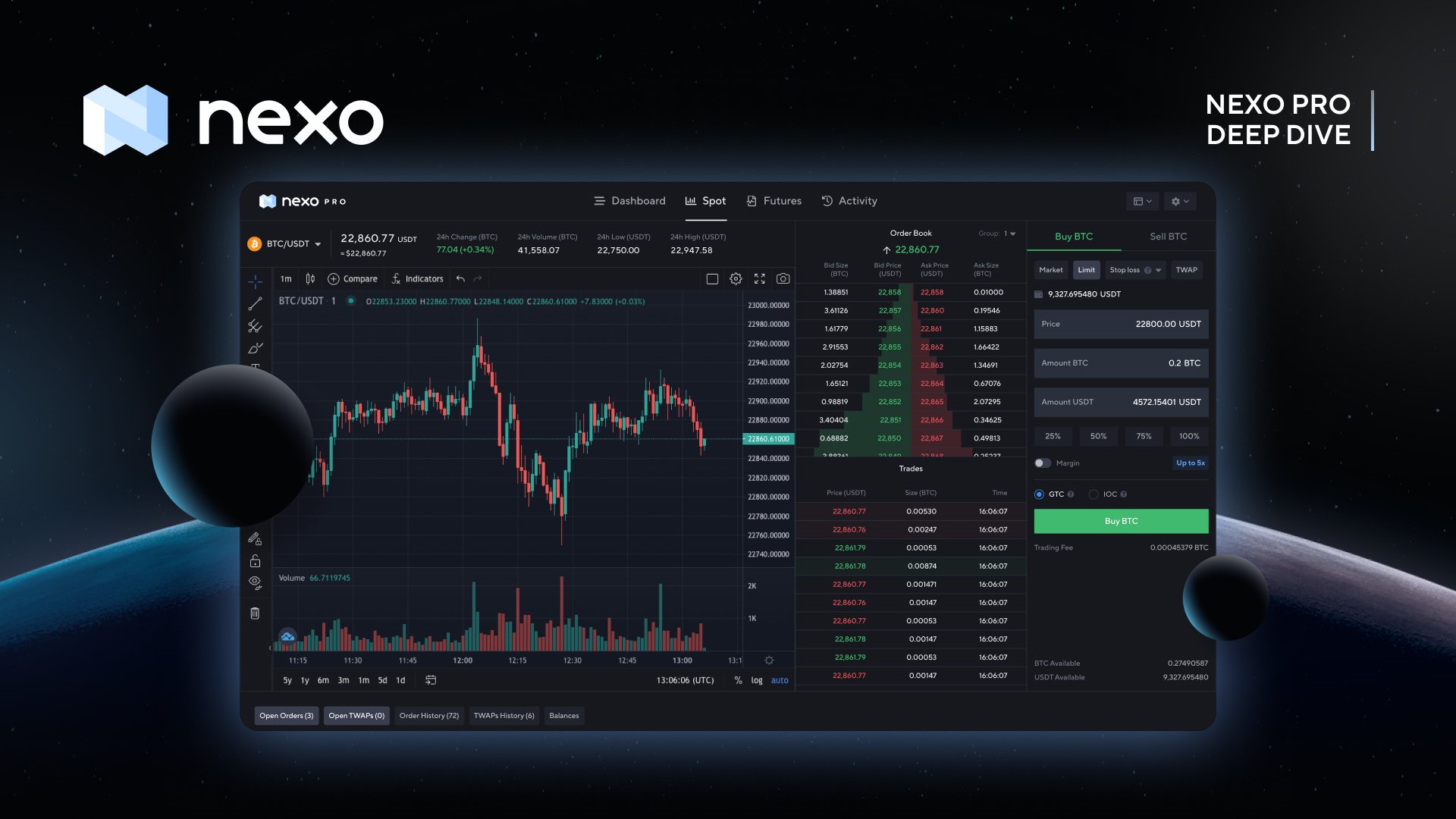

To execute your first order on Nexo Pro, you need to understand crypto pairs first. Their function is to show you the relative worth of a specific crypto asset to another, at any given time. For example, a BTC/USDT pair will show you how much Bitcoin is valued in terms of Tether. To make a trade, you need to choose a pairing where you possess at least one of the currencies. All 400+ pairs on Nexo Pro are available from the drop-down menu in the top left-hand corner of your screen.

- Market Order

The most basic order type. If you have ever used the traditional Nexo Exchange, you’ve already completed a market order, perhaps without even realizing it. Market orders are completed instantly at the current market price (i.e. spot price). If you want to buy a crypto asset, the algorithm automatically finds a seller in the order book. This is the place where all buy and sell orders are gathered. Once the algorithm has found a seller, it executes the transaction at the best available spot price. Usually, this price depends on how much of a specific asset you want to buy or sell. The larger the amount, the bigger the difference between the best price you can get and the price you pay. To close this gap, we use aggregated liquidity, which you can learn about below.

To place a market order for buying BTC on Nexo Pro, select a pair with Bitcoin and another crypto asset you already have on the platform, such as USDT. Enter the amount of USDT you’d like to spend or the amount of BTC you want to buy, and the algorithm will automatically take care of the rest. Select ‘Buy BTC’, and you’re done.

- Limit Order

Here’s your first more advanced order type. With limit orders, you buy or sell a crypto asset in the future at a specified price. This way, you set your target price in advance and wait for the algorithm to fill it. Essentially, the price is the condition for the trade to happen, which means there is a chance that a successful transaction may not occur. There are two types of limit orders available on Nexo Pro, with more coming up soon.

- GTC (Good-Till-Cancel) - The default limit order on Nexo Pro. When set, GTC orders remain active until either executed at the moment, the target price is reached, or when canceled by the trader. Currently, you can place GTC buy orders at a lower than market price and GTC sell orders at a higher than market price.

- IOC (Immediate-Or-Cancel) - A target price and order size are set, and the order is immediately executed if there is available liquidity. What differentiates IOC from GTC limit orders is that they only require a partial fill. This makes it suitable for avoiding a large order from getting filled at different prices. Let’s say you want to buy 150 BTC at $25,000, and the current price is $24,990. The order book doesn’t have enough sellers who want to sell this many Bitcoins at that price, so your IOC order automatically cancels any part of the order that doesn’t fill immediately. You may end up with 140 BTC bought at prices between $24,990 and $25,000, and the remaining 10 BTC will be canceled. With GTC, you would have still bought 140 BTC at the same price, but you would have had a limit order leftover for the remaining 10 BTC at $25,000.

The process for placing a limit order is the same as the market order, with the exception that you need to set a target buy or sell price.

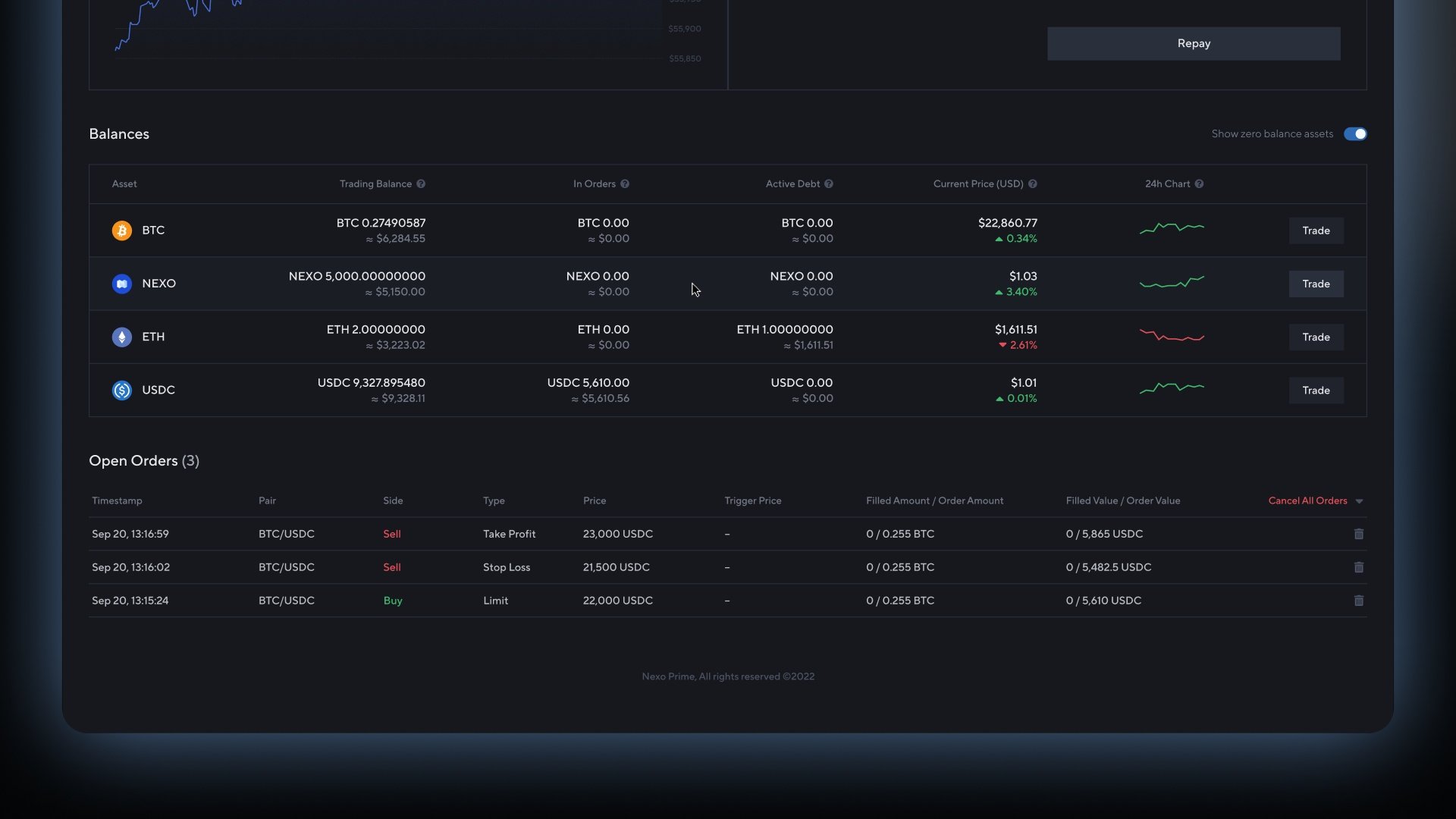

- Stop Loss Order

The stop loss order is an exit strategy for your trades. With these orders, you set a trigger price that will close your position. At the time the trigger price is met, a market order will be placed automatically, thus minimizing your losses.

To set your stop loss, select your trigger price at which you want to exit your position and select how much of the chosen cryptocurrency you’d like to sell.

- Take Profit Orders

With take profit orders, you set a trigger price that will close your position at a potential gain. Like stop loss, a market order will be placed automatically, and the process of setup is the same.

Stop loss and take profit orders, unlike limit orders, are not visible to the market and can’t be seen in order books. Since, in nature, they are market orders, they always get filled even if the current price is higher/lower than expected.

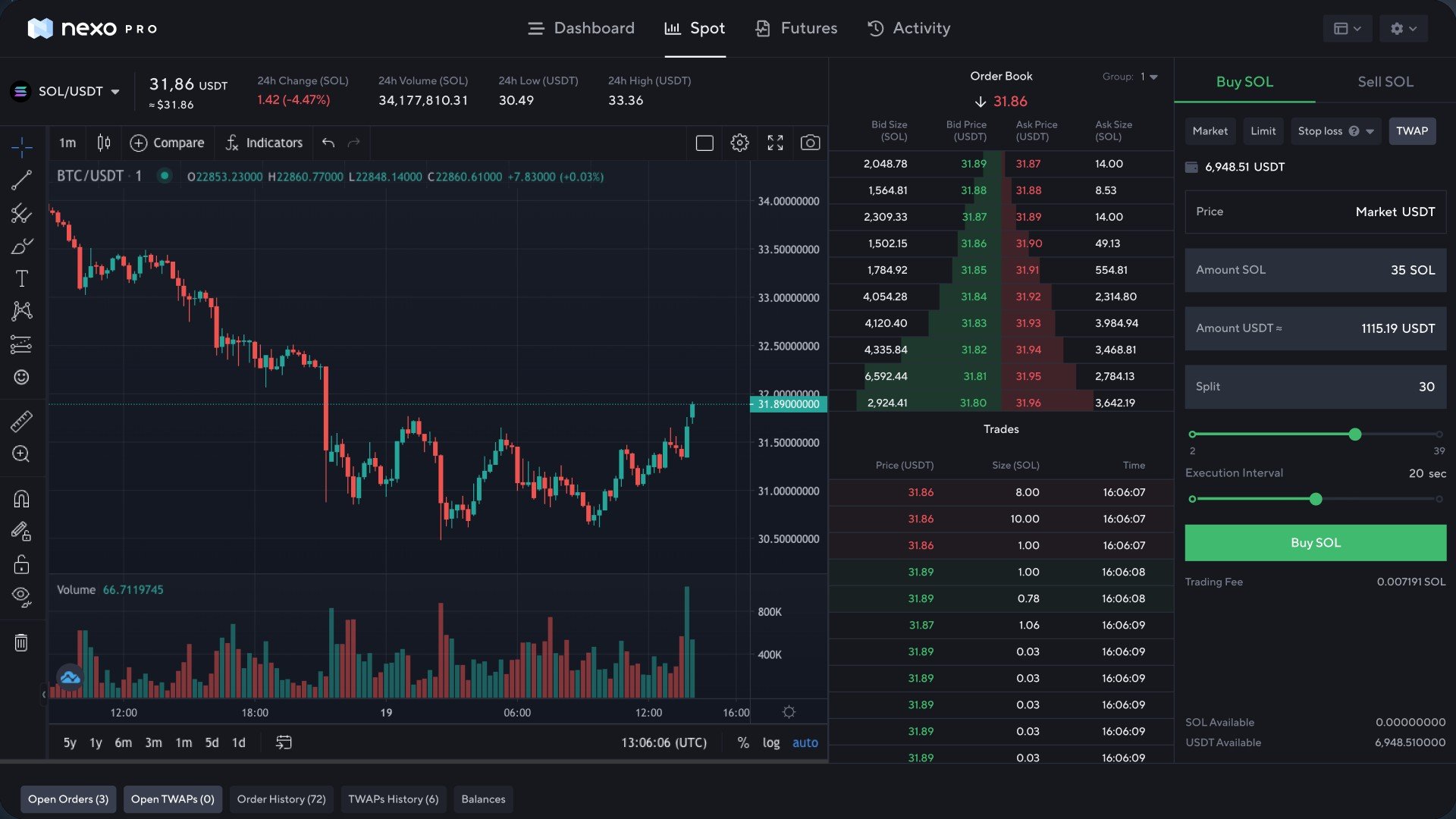

- TWAP Orders

Let’s get into an algorithmic strategy that can make your life easier and help you increase profits. The TWAP (Time-Weighted Average Price) lets you distribute a large order into a few small ones, thus taking the average price of an asset over equal intervals of time. This negates the effects of larger “whale” orders which significantly affect the price of a cryptocurrency.

To set up a TWAP order, you need to fill in the number of trades to be executed in the ‘Split’ field. If you’re trading a big amount, you can benefit from adding more consecutive trades. You also need to set the ‘Execution Interval’ slider to 10, 20, or 30 seconds. This is the time interval between your orders.

On the Nexo Pro dashboard, you can see your balances and track your open orders. Here’s an example strategy that can be applied.

You can apply 5x leverage for market and limit orders on Nexo Pro*. You only need to ensure that margin trading is activated on your account. In a subsequent article, we will take a closer look at margin trading on Nexo Pro.

All these orders are available on Spot Trading, and we work to have them on Futures soon. We’re also looking to add more order types and automated strategies for Spot Trading, so keep an eye out.

Liquidity Aggregation and How It Affects Trading Volume and Order Books?

By reading what’s a market order, you’ve probably realized that the larger the order book, the higher the chance you get the best available price. That’s because the more buyers and sellers there are, the more orders there will be, and the algorithm will match them accordingly. This also means you will see a larger trading volume, which is the number of units or the dollar value of an asset traded during a given time. On Nexo Pro, you can see the trading volume denominated in the total number of units of an asset traded for 24 hours.

Now that you know it’s extremely beneficial to trade on a platform that has a large order book, it’s important to get familiar with the concept of liquidity aggregation. This is the process of collecting buy and sell orders from different sources and directing them to our own platform. This increases the depth of the order book you’re seeing on Nexo Pro, which delivers better fills on the order flow when compared to using a single liquidity provider.

Nexo Pro aggregates liquidity from crypto exchanges, as well as leading market makers and 3rd party providers. In total, we collect orders from 3,000+ order books derived from 10+ providers and spread into 400+ liquidity pools for every crypto pair available. This gives you:

- The best possible price out of all the providers = more profits

- A single intuitive interface to trade from = convenience

- Instant order execution = no missed opportunities

- Near-zero slippage = again, more profits.

How To Start Trading on Nexo Pro?

Now that you know all about the orders on Nexo Pro, you’re ready to add funds and start trading.

- To log in, you need to use your existing Nexo account. If you do not have a Nexo account yet, click here and choose 'Create Account’.

- To add funds to Nexo Pro, you need to top up assets from your Nexo account. If you don't have funds in your Nexo account, you can do it through a direct crypto top-up from an external wallet or a purchase with your debit/credit card. An alternative is a EUR, GBP, or USD bank transfer.

Top-ups to Nexo Pro are instant and free, and you can transfer any cryptocurrency and USD from your Savings Wallet. Transitioning from earning and borrowing against your crypto to trading it is as smooth as it can be, and you can do it as many times as you’d like.

Even inexperienced traders are already taking advantage of the professional tools available on Nexo Pro. You can get started today and benefit from 50% lower trading fees. Enjoy the perks of aggregated liquidity, advanced order types, and, as ever, manage trading risk prudently.

*Margin Trading and the Futures Exchange are currently unavailable for residents of the United States of America, Canada, and Australia.