-

Market is down 4.72% in the last 24 hours

- Private Clients

-

Blog

-

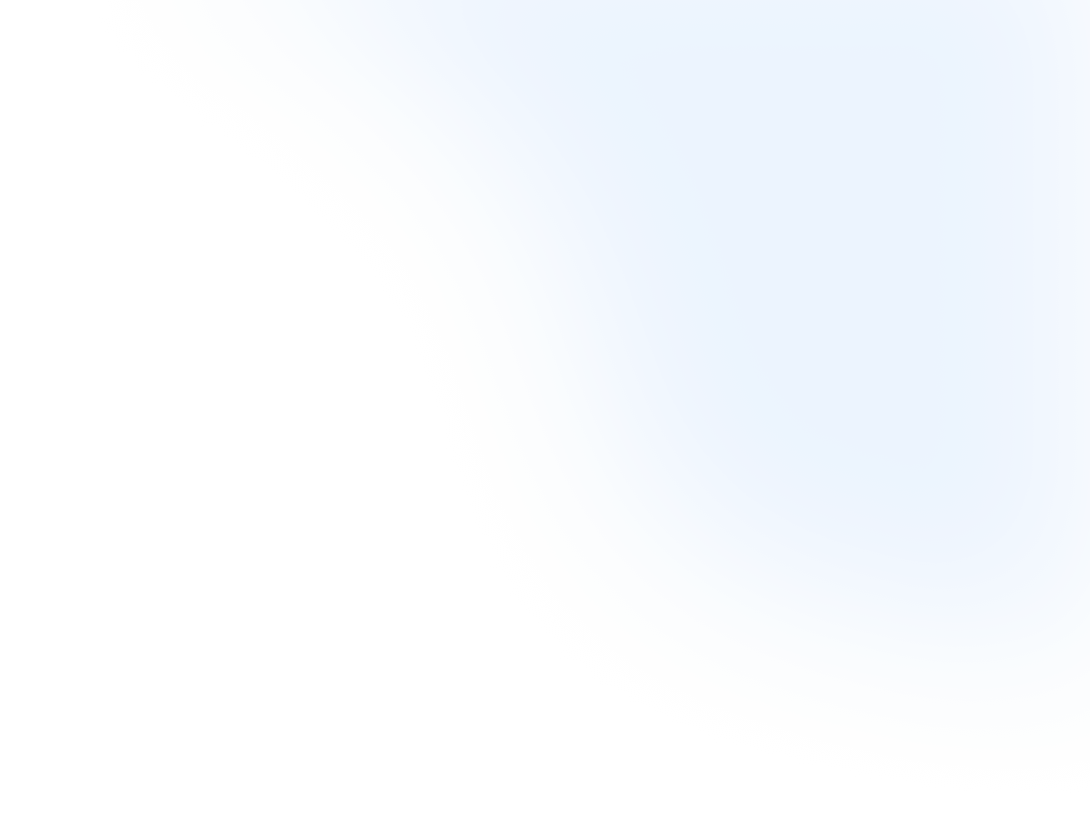

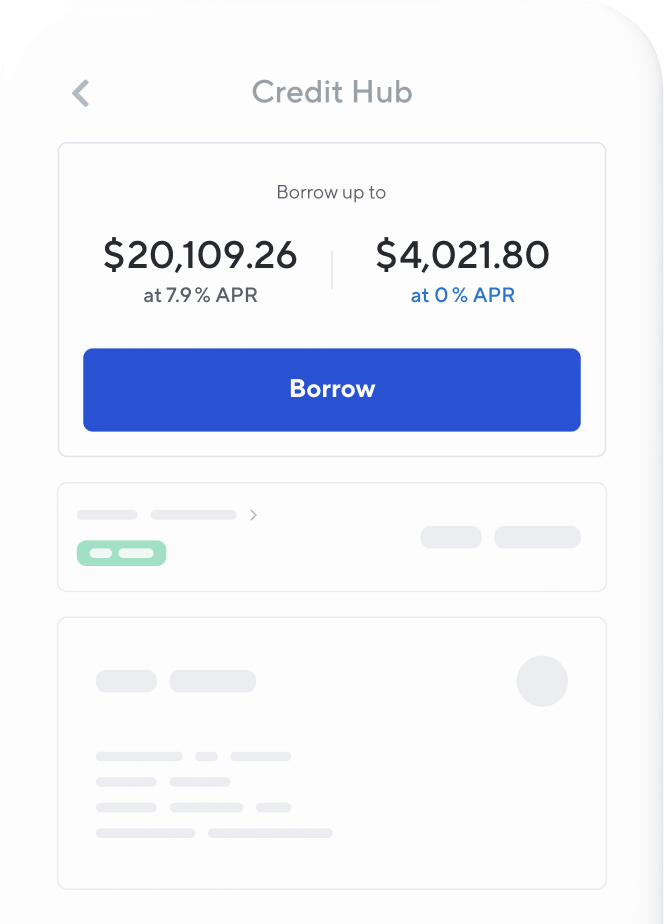

Get as much or as little as you want, whenever you want with the most flexible crypto credit line out there.

|

Instant Crypto Credit Lines |

Conventional Loans |

|

|---|---|---|

|

Opportunity to grow

your portfolio |

|

|

|

Lower interest rates

|

|

|

|

No origination fees

|

|

|

|

Tax-efficiency

|

|

|

|

Instant approval

|

|

|

|

No paperwork to fill

|

|

|

|

No monthly repayments

|

|

|

|

No impact on credit score

|

|

|

Thanks to its direct link to your credit line, the free Nexo Card is great for quick spending on everyday purchases.

NEXO Token

NEXO15% LTV

Ethereum

ETH50% LTV

Bitcoin

BTC50% LTV

Pax Dollar

USDP90% LTV

DAI

DAI90% LTV

USD Coin

USDC90% LTV

USDT

USDT90% LTV

PAX Gold

PAXG70% LTV

Optimism

OP33% LTV

Axie Infinity

AXS33% LTV

Polygon

MATIC33% LTV

Fantom

FTM33% LTV

THORChain

RUNE33% LTV

NEAR Protocol

NEAR33% LTV

Cosmos

ATOM33% LTV

Kusama

KSM33% LTV

Avalanche

AVAX33% LTV

Toncoin

TON30% LTV

Pendle

PENDLE30% LTV

Shiba Inu

SHIB30% LTV

Wormhole

W30% LTV

Ethena

ENA30% LTV

ONDO

ONDO30% LTV

SEI

SEI30% LTV

SUI

SUI30% LTV

Injective

INJ30% LTV

The Graph

GRT30% LTV

Pancake Swap

CAKE30% LTV

Enjin Coin

ENJ30% LTV

Basic Attention Token

BAT30% LTV

Algorand

ALGO30% LTV

Hedera

HBAR30% LTV

Worldcoin

WLD30% LTV

yearn.finance

YFI30% LTV

Kyber Network

KNC30% LTV

Balancer

BAL30% LTV

Osmosis

OSMO30% LTV

Synthetix

SNX30% LTV

Convex Finance

CVX30% LTV

Compound

COMP30% LTV

STEPN

GMT30% LTV

Frax Share

FXS30% LTV

Ethereum Name Service

ENS30% LTV

1inch Network

1INCH30% LTV

Chiliz

CHZ30% LTV

Maker

MKR30% LTV

Lido DAO

LDO30% LTV

Curve DAO

CRV30% LTV

dYdX

DYDX30% LTV

SushiSwap

SUSHI30% LTV

The Sandbox

SAND30% LTV

Decentraland

MANA30% LTV

Uniswap

UNI30% LTV

Dogecoin

DOGE30% LTV

Aave

AAVE30% LTV

Arbitrum

ARB30% LTV

Chainlink

LINK30% LTV

EOS

EOS30% LTV

Stellar

XLM30% LTV

Bitcoin Cash

BCH30% LTV

Litecoin

LTC30% LTV

GMX

GMX30% LTV

Cardano

ADA30% LTV

Celestia

TIA30% LTV

Solana

SOL30% LTV

BNB

BNB30% LTV

Polkadot

DOT30% LTV

XRP

XRP30% LTV

Gala

GALA25% LTV

ApeCoin

APE25% LTV

Aptos

APT15% LTV

Sweat Economy

SWEAT10% LTV

Terra

LUNA20.01% LTV

TrueUSD

TUSD0.01% LTV

Huobi Token

HT0.01% LTV

Tron

TRX0.01% LTV

US Dollar

USDBorrow

Euro

EURBorrow

British Pound

GBPBorrow

USDT

USDTBorrow

USD Coin

USDCBorrow

30+ more fiat currencies

If your collateral starts to depreciate, our Nexo blockchain oracle will send you an email encouraging you to partially repay your crypto credit or add extra collateral.

In case you don’t take any action, the blockchain oracle will automatically transfer assets from your Savings Wallet to your Credit Wallet to keep your credit line health in check.

And if you don’t have assets in your Savings Wallet, the Nexo blockchain oracle will use portions of your collateral to initiate automatic credit repayments – just enough to fill the gap.

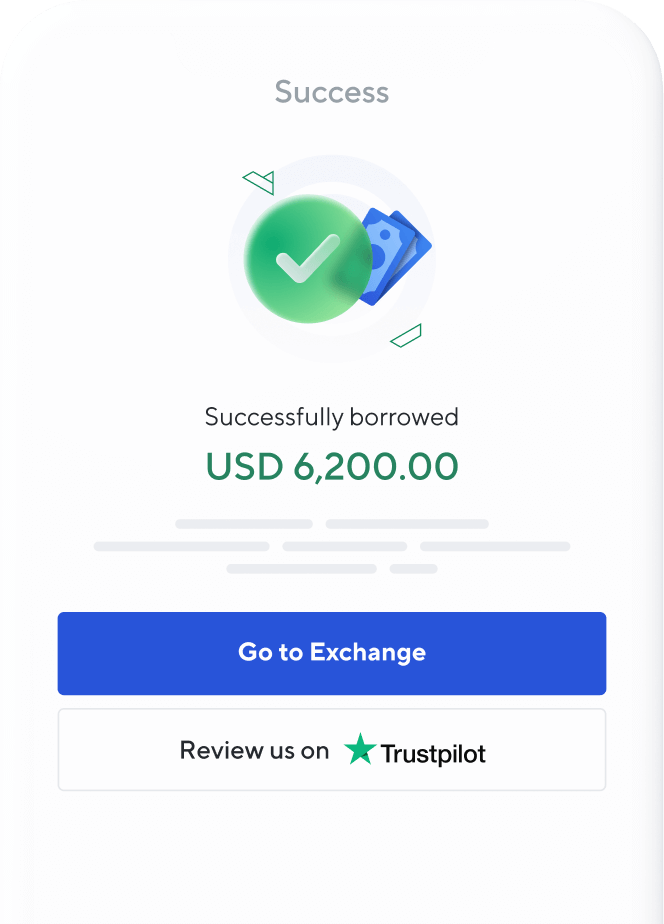

Open your Nexo account right now and monetize your digital assets within minutes.