-

Market is down 0.35% in the last 24 hours

- Private Clients

-

Blog

-

Introduce your friends to the world of crypto and receive $25 paid out in Bitcoin for each successful referral.

Start Inviting

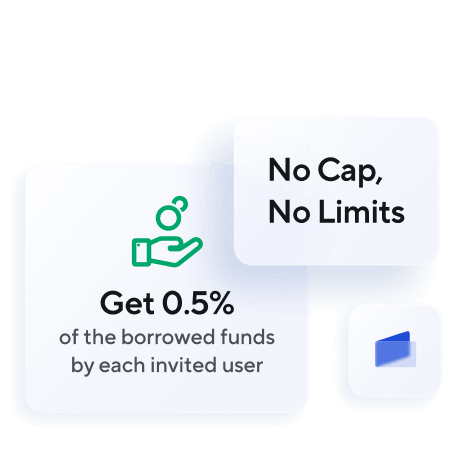

Get a revenue share by joining Nexo's Affiliate Program. Make money every time an invited user makes a swap or borrows funds on the Nexo platform.

Become an Affiliate

SOC 2 Type 2

SOC 2 Type 2Our proven real-time risk engine and strict collateralization requirements ensure we generate earnings in a safe way.

Learn MoreAll digital assets benefit from insurance from our custody partners such as Ledger Vault and Fireblocks.

Learn More

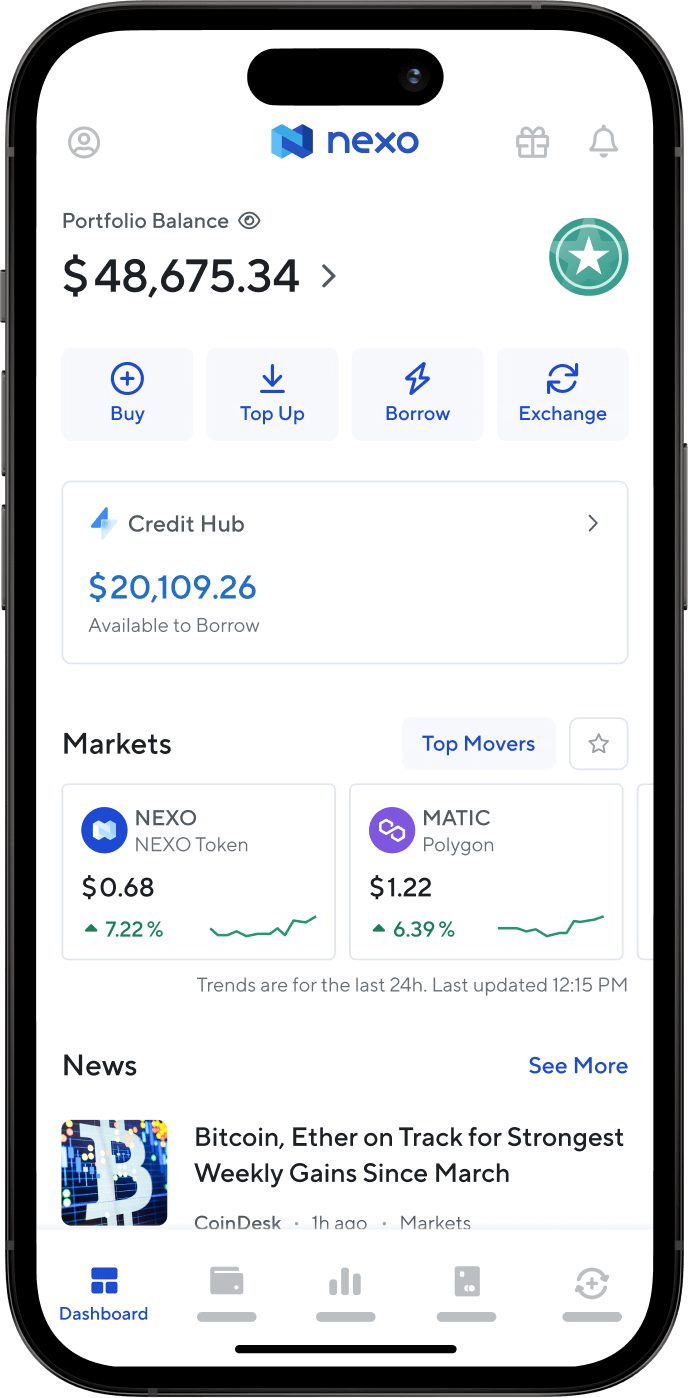

Buy digital assets, borrow against them, or exchange between 500+ market pairs on the highly-rated Nexo app.